-

-

Featured Care Areas

Integrated Shield Plans

Private healthcare is more affordable than you think. Your Integrated Shield Plans can help pay for the cost of your private hospital stay at Mount Elizabeth Hospitals. Know your options.

Using your Integrated Shield Plan for private healthcare

An Integrated Shield Plan (IP) is health insurance consisting of 2 parts:

MediShield Life which is the basic health insurance plan managed by the Central Provident Fund (CPF) Board. MediShield Life premiums can be paid by MediSave.

Private health insurance which:

- Provides additional coverage for Class A or B1 wards in restructured hospitals and private hospital stays

- Offers riders to cover the cost of the deductible (the fixed amount you must pay before your insurance kicks in) and co-insurance (the percentage you must pay after your insurance kicks in) which can be minimised to 5% with a co-pay rider

Your health should not have to wait. Learn more about Integrated Shield Plans, so that if the unexpected happens, you can get treated promptly and just focus on your recovery.

Visit HealthInsured.sg for helpful non-bias information on all things health insurance in Singapore.

Find out your coverage and bill size

To find out more about your Integrated Shield Plan coverage, contact Parkway Insurance Concierge by calling +65 9834 0999 or via WhatsApp to +65 9834 0999.

You can also use our Hospital Bill Estimator to get an estimate of your out-of-pocket expenses for common surgical procedures.

Insurance terms explained

Confused by the insurance terms used in an Integrated Shield Plan? Here's what they mean:Collapse All

The deductible is the basic amount you must pay for your bill before you make an insurance claim. The deductible is capped at a fixed sum. If the bill is less than the deductible, you will pay the full bill.

For example, if your bill size is $10,000 and your private hospitalisation deductible is fixed at $3,500 for your Integrated Shield Plan, you must first pay $3,500 before making an insurance claim for the remaining $6,500.

Collapse All

Co-insurance is the amount you have to co-pay with your insurer after you have paid the deductible.

For each claim you submit, you will split the cost with your insurer. The co-insurance is expressed as a percentage of the claim and is typically 10% for Integrated Shield Plan. Your insurer will foot the remaining bill.

For example, if your hospitalisation bill is $10,000 and your deductible is $3,500, your co-insurance will be 10% of $6,500, which is $650. This means you will pay a total of $4,150 (deductible and co-insurance) while your Integrated Shield Plan will pay the rest of the bill.

Collapse All

Co-payment is the percentage, usually 5%, you have to pay towards your hospital bill when you submit an insurance claim.

If you have purchased a co-pay rider with your Integrated Shield Plan, the rider will cover your deductibles and co-insurance to reduce your out-of-pocket expenses.

Depending on your rider plan, most insurers set the co-payment at 5% with a cap of $3,000 if you seek treatment from your insurer's preferred panel of doctors, and the treatment has been pre-authorised by your insurer.

This means you only need to pay up to $3,000 if your co-payment amount exceeds the cap. The remaining co-payment amount will be covered by your insurer.

Collapse All

For certain Integrated Shield Plans under AIA, it is important to seek pre-authorisation from your insurer before your procedure. Without pre-authorisation, AIA will apply a pro-ration factor on your claim.

For example, if your claim is $10,000, your insurer will only cover 85% of the claim without pre-authorisation. You will need to pay for the remaining amount.

Collapse All

There are 2 types of limits for Integrated Shield Plans:

- Lifetime limit is the maximum amount you can claim in your life

- Policy year limit is the maximum amount you can claim in the policy year

Collapse All

Insurers have their preferred doctors whom they have selected to be on their panel. You may enjoy enhanced coverage and higher claim limits if you are treated by your insurer's panel doctors.

Collapse All

The extended panel refers to a doctor who is currently not on a certain insurer’s main panel, but is on the approved list of panel doctors of the other Integrated Shield Plan providers. He/she can then apply and be approved by the insurer to be on the extended panel.

To qualify as an extended panel claim, a certificate of pre-authorisation must be issued, subject to the insurer’s acceptance. This allows consumers to have a wider pool of doctors to choose from.

Collapse All

Pre-authorisation is a service where your insurer agrees to cover your hospital admission or day surgery costs prior to the actual procedure. Pre-authorisation is based on your policy coverage, benefit entitlement and medical information provided by your doctor.

Where possible, you should always seek pre-authorisation before you begin treatment. This can ease the claim process and may allow you to enjoy a higher coverage.

Please allow sufficient time to process the pre-authorisation. Most insurers can provide pre-authorisation within a week.

Collapse All

Claims-based pricing is a way to adjust premiums for your riders based on the claims paid out to you by your insurer during the previous policy year.

With claims-based pricing, your rider premiums at each policy renewal may increase or decrease. You will receive a discount of 10% to 25% off your premium if no claims were made in the previous policy year.

If a claim was paid out, your premium may increase by 10% to 100% of the standard premiums before they return to the standard level in the next renewal. The increase is determined by each insurer and depends on factors such as:

- Whether you stayed at a private or restructured hospital

- Whether your doctor is from your insurer's panel of doctors

- The amount claimed

- Your age

What you need to know about Integrated Shield Plans (IPs)

A: An Integrated Shield Plan consists of MediShield Life and additional private health insurance coverage.

MediShield Life is a basic health insurance plan that covers all Singapore citizens and permanent residents.

Key features:

- Managed by CPF

- Provides coverage for life

- Covers pre-existing conditions

- Covers treatment costs for Class B2 or C wards at public hospitals

- Premiums can be paid with your MediSave

Additional private insurance covers treatment at private hospitals or Class A and B1 wards at public or restructured hospitals.

Key features:

- Managed by private insurers

- Includes the option to purchase additional rider to partially cover the co-insurance and deductible components of the bill

- Premiums can be paid with your MediSave, up to the annual Additional Withdrawal Limits:

- $300 per year if you are aged 40 years and below on your next birthday

- $600 per year if you are aged 41 – 70 years on your next birthday

- $900 per year if you are aged 71 years and above on your next birthday

- Rider premiums can be paid by cash only

Note: The Additional Withdrawal Limits may be subject to change. Please visit the Ministry of Health website for the latest information.

Depending on the plan you purchased, Integrated Shield Plans and riders can provide coverage for:

- Higher ward classes or stay at a private hospital

- Higher annual claim limits

- Claims for pre- and post-hospitalisation treatments

- Shorter waiting time to see specialists. At Mount Elizabeth Hospitals, Gleneagles Hospital and Parkway East Hospital, you can get an appointment with a specialist within 24 hours.

- Choice of doctors

If you have an Integrated Shield Plan and rider, you may be partially or even fully covered (for some existing policies) for treatment and single-room stay at private hospitals.

To find out more about your Integrated Shield Plan coverage, contact Parkway Insurance Concierge by calling +65 9834 0999 or via WhatsApp to +65 9834 0999.

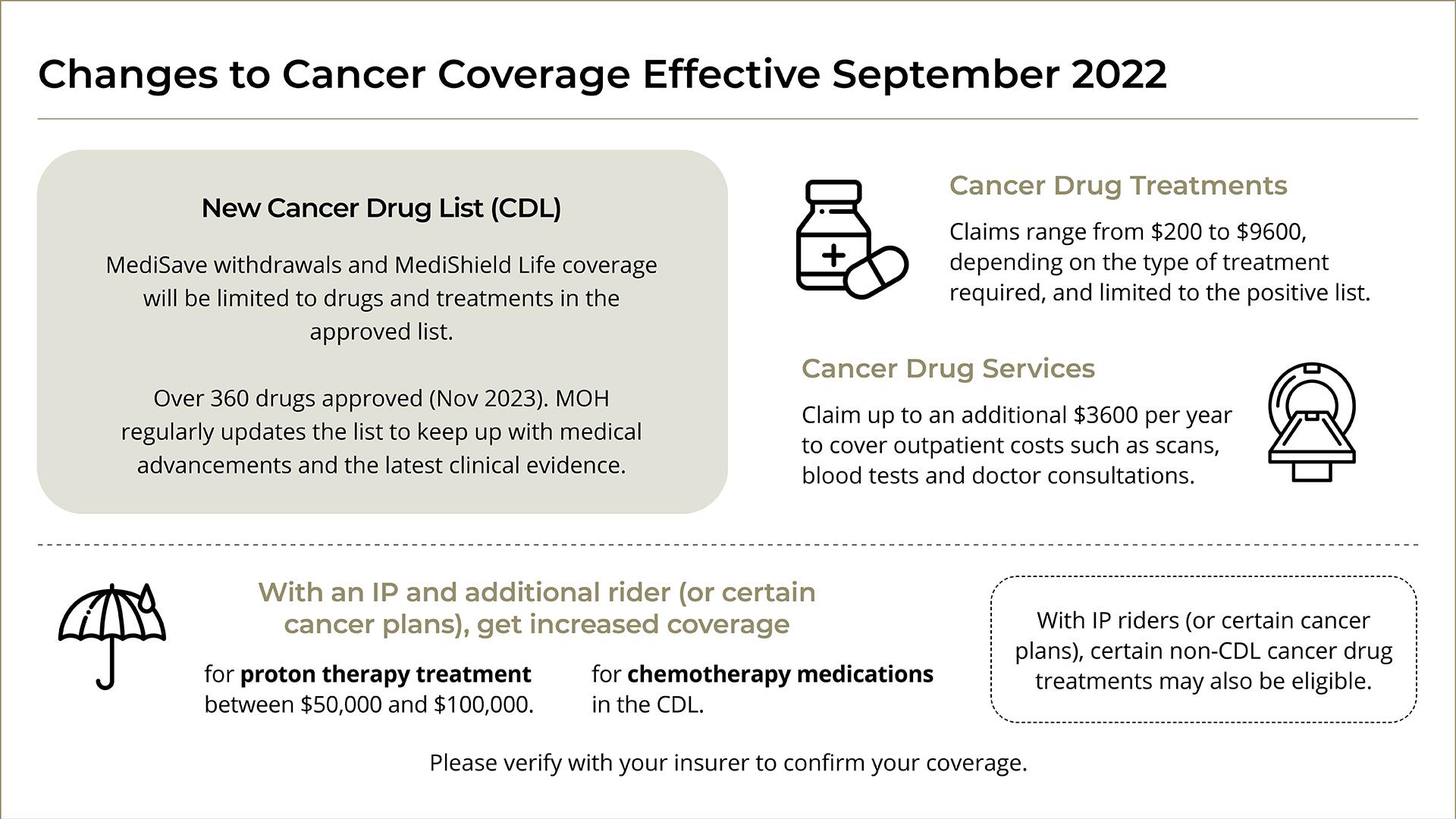

A: Since September 2022, all MediShield Life coverage and MediSave withdrawals only cover treatments on the Cancer Drug List (CDL). Each cancer drug treatment on the CDL has its own MediShield Life claim limits and MediSave withdrawal limits. If more than one CDL drug is used, the limit will be capped at the drug with the higher limit.

Patients with an IP rider may still be able to claim for certain outpatient cancer treatment drugs even if they are not on the approved list.

The Ministry of Health (MOH) has stated that around 90% of cancer drug treatments used in public healthcare institutions in Singapore are covered. These revised limits will help to keep public healthcare costs low, allow MOH to negotiate lower prices for cancer drugs, and ensure that cancer treatment costs and insurance premiums remain affordable in the long term.

In addition, the claims for cancer treatment from MediShield Life have also been split into two categories – drugs and services.

Claims for cancer services – which include everything else, such as consultation fees, tests and supportive drugs that treat for symptoms caused by the treatment – are capped at $1,200 a year.

From April 2023, the limits were also extended to claims under IP. IPs will now pay up to five times the MediShield Life claim limit for cancer treatment instead of on “as-charged” basis.

These changes do not affect IP riders, which are paid for fully in cash. With IP riders, selected non-CDL cancer drug treatments will be claimable as well.

Please check with your insurer to find out more about your IP plan.

A: To find out if you have an Integrated Shield Plan:

- Go to cpf.gov.sg.

- Log on to my cpf Online Services with your SingPass.

- Go to My Messages.

- See the Insurance section.

To find out the policy details of your Integrated Shield Plan, please refer to your policy document or contact your insurer or financial advisor.

A: If you have an Integrated Shield Plan (IP) and a rider that provides coverage for private hospitals, you may be covered for treatment at our hospital.

Below is a list of private hospital plans and co-pay riders offered by various insurers:

AIA

- Plan: HealthShield Gold Max A

- Co-pay rider:

- Max VitalHealth A Value

- Max VitalHealth A

- Max VitalCare*

Great Eastern

- Plan: SupremeHealth P Plus

- Co-pay rider:

- TotalCare Elite-P

- TotalHealth Elite-P

HSBC Life

- Plan: HSBC Life Shield Plan A

- Co-pay rider:

- Enhanced Care

NTUC Income

- Plan: Enhanced Income Shield Preferred / Income Shield Plan P*

- Co-pay rider:

- Deluxe Care Rider

- Classic Care Rider

- Assist Rider*

- Plus Rider*

Prudential

- Plan: PRUShield Premier

- Co-pay rider:

- Premier CoPay

- Premier Lite CoPay

- Preferred CoPay

- Premier*

Raffles Health Insurance

- Plan: Raffles Shield Private

- Co-pay rider:

- Key Rider

- Premier Rider

Singlife

- Plan: Singlife Shield Plan 1

- Co-pay rider:

- Singlife Health Plus-Private Prime

- Singlife Health Plus-Private Lite

- MyHealthPlus Option A*

- MyHealthPlus Option A-II*

- MyHealthPlus Option B*

- MyHealthPlus Option C*

- MyHealthPlus Option C-II*

Please check with your insurer for your full policy details.

*These are old rider plans that are no longer offered by the insurers for new customers.

A: Due to the Ministry of Health's requirements, insurers no longer offer full riders from 1 April 2019. You may only purchase co-pay riders with a minimum of 5% co-payment.

With the exception of Prudential's PruExtra Premier Rider, all full rider plans purchased by existing policy holders have transitioned to co-pay riders upon policy renewal from 1 April 2021.

With a co-pay rider, your out-of-pocket expense is:

- Not likely to exceed 5% of your total hospital bill

- Capped at $3,000, if you obtain pre-authorisation with your insurer prior to your surgery with a specialist on the insurer’s panel

- Subject to annual and lifetime policy claim limits

For example, if your bill size is $20,000, your co-payment amount may be $1,000 if you have obtained pre-authorisation and done the treatment with a specialist on your insurer’s panel.

Your co-payment amount may be offset partially or fully by MediSave or your corporate insurance. Please check with your Human Resource department if you are covered under a corporate insurance.

For the latest policy changes, please check with your insurer.

Tip: Use our Hospital Bill Estimator to estimate your out-of-pocket expenses for common surgical procedures.

A: Extended Panel is an initiative by the Multilateral Healthcare Insurance Committee (MHIC), which is appointed by the Ministry of Health (MOH), to allow Integrated Shield Plan insurers to recognise each other’s panel doctors mutually.

Under the Extended Panel, you may enjoy selected panel benefits when seeking pre-authorised treatments from specialists that are not on your insurer’s panel, if they are on other Integrated Shield Plan insurer panels, follow your insurer fee schedule and meet their pre-authorisation terms. This initiative provides consumers with a wider choice of specialists and supports better continuity of care for patients.

To qualify for an Extended Panel claim, complete these steps before your planned treatment:

- Obtain a pre-authorisation form from your insurer

- Request for your doctor to fill in the form and submit it to your insurer

A: Before admission, contact your insurance provider to check your plan's coverage for private hospitalisation.

During admission, our Business Office will get your consent for the Medical Claims Authorisation Forms (MCAF) and assist you in using your Integrated Shield Plan.

Find out about more about using your health insurance.

A: Pre-authorisation is always recommended for planned treatments. It can ease the claim process and may help you enjoy higher coverage.

Find out more about using your health insurance.

A: Some insurers such as AIA, Great Eastern and Prudential have introduced claims-based pricing for selected Integrated Shield Plans.

With claims-based pricing, your rider premiums at each policy renewal are adjusted based on your claims during the previous policy year. The adjustments differ across insurers.

For example, for a Great Eastern TotalCare Elite-P Co-pay rider as of 15 May 2023, the standard annual premium for a co-pay rider at 38 years old is $972.30. If a claim is made at a private hospital through Great Eastern’s panel of specialists in 2023, your premium for the next policy year (2024) will remain the same.

In another scenario, for a Prudential PruShield Premier Co-pay rider as of 15 May 2023, the standard annual premium for a co-pay rider at 55 years old is $1,772. If a claim is made at a private hospital not in Prudential’s panel of specialists or extended specialists in 2023, your premium for the next policy year (2024) will increase by 1.2 times to $2,136.40, for a rider claim amount between $1,001 to $5,000.

Please check with your insurer to find out more about your plan and premiums.

A: Your Integrated Shield Plan can also serve as an emergency medical insurance if your visit to our 24-Hour Urgent Care Centre warrants a hospital admission with a minimum stay of 8 hours.

If your Integrated Shield Plan and rider cover private hospitals, you only need to pay a minimal amount for both your outpatient bill and your inpatient treatment.

Some policies also cover the outpatient treatment up to a certain limit and can be used as both accident health insurance and emergency health insurance. Contact your financial advisor to understand your full policy details.